Article

Portugal Homes

Get the best property advice.

Portugal, with its stunning landscapes, rich cultural heritage, and a quality of life that ranks among the best in the world, has long been an attractive destination for foreigners. Over recent years, this appeal has only grown stronger as the country has become a hub for expats, entrepreneurs, retirees, and young professionals alike. To make homeownership more accessible and affordable for young adults under the age of 35, the Portuguese government has introduced new tax exemptions on IMT (Imposto Municipal sobre Transmissões) and IS (Imposto de Selo). This strategic initiative should also further solidify the country’s position as a top choice for international investors, as people from any nationality can be eligible the exemptions.

Understanding IMT and the Housing Market in Portugal

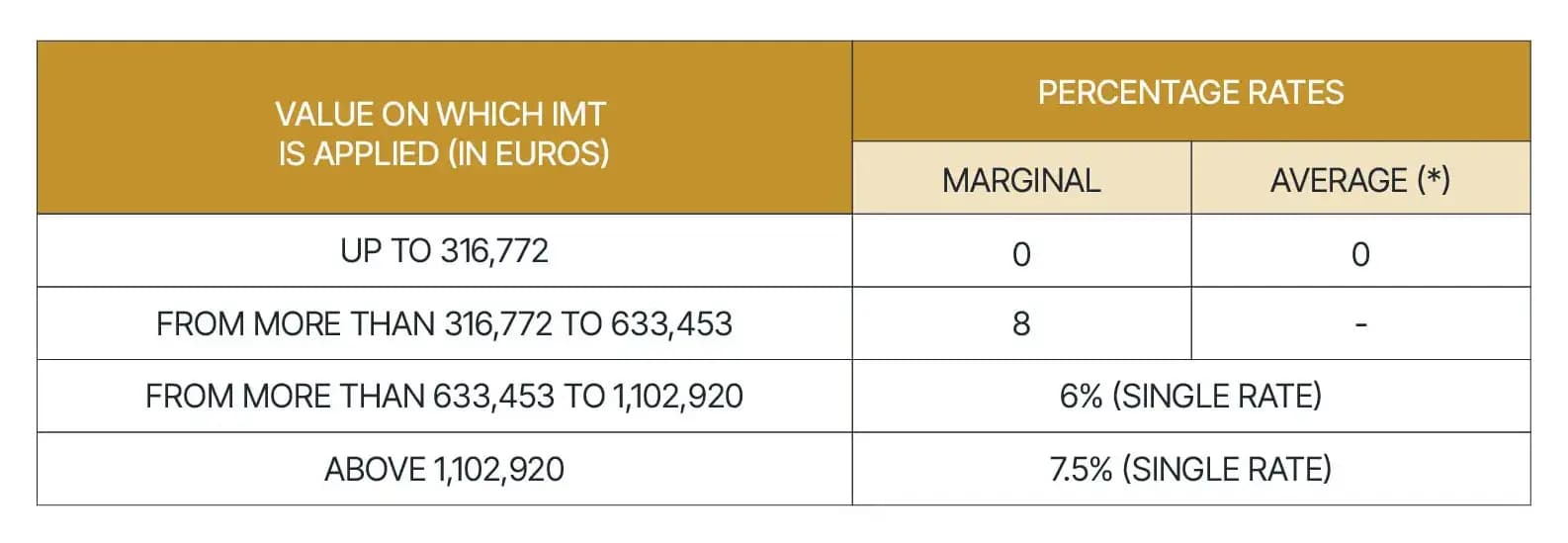

Before diving into the details of the new tax exemptions, it is important to grasp the significance of IMT in the context of Portugal's real estate market. IMT, or the Municipal Property Transfer Tax, is a tax that buyers must pay when purchasing property in Portugal. The rate of this tax varies depending on several factors, including the value of the property, its location, and whether the buyer intends to use it as their primary and permanent residence. Typically, the IMT rate can range from 0% to 8%, making it a substantial part of the overall cost of purchasing a home.

In recent years, the Portuguese real estate market has experienced significant growth, driven by both domestic demand and international investment. Cities like Lisbon, Porto, and the Algarve region have seen property prices surge as they become increasingly popular with foreign buyers. However, this rise in property values has also led to higher costs of living and increased barriers to homeownership, particularly for younger individuals who may not have the financial resources to compete in such a competitive market.